New Jersey will be the first or second state to act on its new right to offer sports betting. Per a report from NJ.com, state lawmakers plan to hold a …

Can Poker’s Biggest Whales Help The WSOP End Aria’s Summer High Roller Dominance?

Up until now, the World Series of Poker has been operating under the philosophy that if they run it, players will come.

The series’ unprecedented track record of success has seen it draw record entry numbers across the board almost every year. Whether they give players more chips, more time, or charge them more rake, most, if not all of the gimmick events the WSOP rolls out always draw big numbers.

They run it and players come. In fact, the WSOP has literally had the Midas touch when it comes to poker tournaments since 2003.

However, this summer, they will heading into uncharted territory.

This year, the WSOP will be making a major effort to keep high rollers at the Rio All-Suite Hotel and Casino Las Vegas. High Rollers have traditionally been more interested in playing down the street at Aria Resort & Casino.

It really marks the first time the WSOP is really competing with anyone for business. They’ve simply run over everyone else who has tried to take them on for the past 15-plus years.

The King’s Lounge High Roller Series

How they plan to keep poker’s best and most affluent players on site is no secret. The WSOP will be running a high roller tournament series that may offer even better value than the one Aria has run alongside the WSOP the past few summers.

The King’s Lounge High Roller Series will consist of a group of $25,000 buy-in and up tournaments. They will run every weekend from Friday, June 1 to Sunday, July 8.

All the tournaments are one-day events. There are no bracelets up for grabs, but if the events draw decently, there should be some big money on the line.

The King’s Lounge is a high roller area the WSOP installed in the Pavilion Ballroom last year. It is sponsored by King’s Casino, the Rozvadov, Czech Republic poker-focused casino that began hosting WSOP Europe last year. It has really become the home of the game in Europe despite its remote locale.

The lounge will play host to three high rollers every weekend throughout the schedule, including:

- $25,000 No-Limit Hold’em Fridays at 8 p.m.

- $25,000 Pot-Limit Omaha Saturdays at 8 p.m.

- $50,000 No-Limit Hold’em Sundays at 8 p.m.

All three tournaments are of the unlimited re-entry variety, with re-entry and late registration open through ten levels.

All three will also be played with a shot clock and a big blind ante. A move that fits in with high roller trends around the globe.

The $25,000 events will take 2.1 percent out of the prize pool for entry fees and another 0.9 percent for tournament dealers and staff.

That amounts to three percent rake on $25,000 events and two percent on $50,000 tournaments. Numbers that bring us to the first bit of value these events are offering high rollers.

The 2018 Aria Summer High Roller Series

Make no mistake about it, the King’s Lounge High Roller Series is running right up against the 2018 Aria Summer High Roller Series.

Aria’s series will run May 25 to July 9. It kicks off with a $100,000 + 2,000 Super High Roller that has just two percent rake.

However, it also features as many as 16 different $25,000 + 1,000 High Roller events charging four percent rake. There’s also a small group of $10,000 + 500 events with five percent rake at the beginning of July.

One might not think a savings of $250 per $25,000 event would make that much of a difference to a high roller. However, that can add up over a lengthy series. Plus, high rollers are value hunters by nature. You may have heard the saying that the wealthiest people in this world didn’t get there by giving away money. The same is true in the poker world.

There is some real value there. So, the rake break might be one reason high rollers choose King’s Lounge over Aria this summer. However, there is another.

New Players Get A Free Bonus At WSOP.com NJ

-

Visit WSOP NJ

Visit WSOP NJ

- $10 No Deposit100% to $400 With Deposit

- WSOP NJ ReviewOverall Grade A-

- Games B+

- Support B

- Banking A-

- Player Value A

Bum-hunting

High rollers hunt value by looking for more than just less rake. They seek out weakness and try to exploit it in any way they can. They want to play where they have an edge and will fly all over the world to find even the slightest increase in expected value.

Put it this way: if all other things are equal, and two high roller events run on the same day, most professional high stakes players are going to try to play in the one with the weakest field.

If they are guaranteed to be up against all pros at Aria, but a field full of 50 percent fun and recreational players are over at the WSOP, most will play the WSOP event.

Some call it bum-hunting. Others say its common sense. Either way, its a fact of high roller life and it brings us to the other bit of value the King’s Lounge events may offer over Aria.

Poker’s biggest whales

King’s Casino owner Leon Tsoukernik made some big headlines for allegedly refusing to pay out millions in losses to poker players including Elton Tsang and Matt Kirk. By most accounts, Tsoukernik has been dumping untold millions in high stakes cash games and tournaments around the world over the past few years. The Kirk and Tsang losses represent just a drop in the bucket.

The stories of “Loose” Leon’s losing are legendary. He’s quickly developed a reputation as poker’s biggest fish. A whale of extraordinary proportions. The likes of which have not been seen since billionaire Cirque du Soleil founder Guy Laliberté allegedly lost as much as $25 million playing online poker under various screenames like LadyMarmalade and Elmariachimacho.

The name of a recreational player on the banner like Tsoukernik, or at least his King’s Casino, may mean the King’s Lounge High Roller Series are where the real fish are this summer. A move that’s sure to attract the sharks.

We’ll have to wait until July to see whether the King’s can outdraw the Aria. Perhaps there’s more to drawing high rollers than just a little value and a few horrible recs.

However, all signs point to King’s and the WSOP giving it a real shot. Even if they have to dangle poker’s biggest fish as bait to give them one.

The post Can Poker’s Biggest Whales Help The WSOP End Aria’s Summer High Roller Dominance? appeared first on .

Did You Miss Him? Phil Ivey Claims A Poker Title, Plans On Playing The WSOP

Ten-time WSOP bracelet winner Phil Ivey stepped into the winner’s circle for the first time since January 2016 this week, earning more than $600,000. And yes, Ivey plans on playing the 2018 WSOP, too.

The post Did You Miss Him? Phil Ivey Claims A Poker Title, Plans On Playing The WSOP appeared first on Play NJ.

Ahead of Shared Liquidity, Online Poker Revenue Drops 33% in Portugal

First full year comparison in segregated Portugal underscores the necessity for cross-border shared liquidity.

Revenue derived from online poker in Portugal dropped 33% annually during the first quarter of the year, according to data released by Serviço de Regulação e Inspeção de Jogos (SRIJ).

Q1 2018 was the first full quarter that year-over-year figures for online poker were available with PokerStars—currently the only online poker operator in the country—having launched on the last day of November 2016.

NJ Online Gambling Revenue Still Going Strong, But Big Changes Are On The Horizon

April’s NJ online gambling revenue hit $23M, a decline from March but still the second-best month for the industry, but interstate poker and sports betting in New Jersey will likely make waves in 2018.

The post NJ Online Gambling Revenue Still Going Strong, But Big Changes Are On The Horizon appeared first on .

New York Now Has Legal Sports Betting! Well, Sorta…

Sports betting might be available in New York sooner than you’d think.

On Monday, the US Supreme Court removed the federal hurdle that stood in the way of state-regulated sports gambling. The court struck down the Professional and Amateur Sports Protection Act (PASPA), ruling that it commandeered states into enforcing an unwanted federal law. The prohibition had been on the books since 1992.

New York has an existing law that allows the four commercial casinos to offer sports betting. That law previously relied on a change at the federal level to become active, a condition that was met this week. Lawmakers have some more work to do in order to finalize the industry’s regulatory structure, though.

Let’s run through the immediate impact the SCOTUS ruling has on the NY gambling landscape.

Is NY sports betting legal now?

Yes… sort of.

You still can’t bet on sports. The concept is legal, but the operations aren’t until regulations are in place.

In 2013, NY voters approved an effort to bring four commercial casinos to the upstate region:

Tribes provided the state’s only full-service casino options prior to the referendum. That referendum also contained an approval for those new properties to offer sports betting, pending the change in federal law that just occurred.

So yes, there is an active law that permits sports betting on the books. However…

That law is fairly sparse in details. It tells sportsbooks who is allowed to place bets. It allows them to give action on all professional sports and most collegiate events. They have to post odds and keep records. Other than that, it’s pretty much up to the NYS Gaming Commission to fill in the blanks. Regulators had been biding their time while waiting for resolution at the federal level.

It might take more than just regulatory work though. Lawmakers and stakeholders see the law itself as incomplete in scope and implementation. More comprehensive legislation has been filed in an effort to cement the guideposts for NY sports betting.

What else does the law need?

For starters, the law probably needs to include the horse racing industry. As written, there are no provisions that would allow tracks to offer sports betting. Since it passed by inclusion in a commercial casino bill, the scope is fairly narrow. There’s no reason not to include the tracks, and a new bill from Sen. John Bonacic would do just that.

Tribal tensions present a lingering issue, too. The nations are pretty peeved about losing their monopoly on NY gambling and concerned about the potential for oversaturation. Offering sports betting without their consideration will certainly not help tribe-state relationships. Bonacic’s bill appears to keep the existing commercial limitation in place.

For that matter, a new referendum could arguably be required to allow mobile and online wagering, as the Bonacic bill would authorize. As it stands, voters must approve all forms of gambling expansion, as they did for the commercial casino project.

It’s debatable whether or not online sports betting would fall under those requirements. Mobile/online betting is one of the primary pillars for any state looking to compete with offshore options.

Lastly, most states are codifying sports betting fees and taxes into law, and those are absent from the existing NY legislation. Money is pretty important to the state, so the payment structure will likely be hammered out quickly. Bonacic proposes a reasonable tax rate of 8.5 percent on sports betting revenue.

It’s also worth noting that one of the fees included in Bonacic’s bill is the controversial integrity fee for sports leagues.

Forward progress had been a little sluggish in recent months, but the sudden change might create new urgency.

Rundown of the SCOTUS ruling

The case SCOTUS decided on Monday was called Murphy vs. NCAA. You might also hear it called the “New Jersey sports betting case.”

“Murphy” is NJ Gov. Phil Murphy, who inherited the defendant’s role in the case from his predecessor, Chris Christie.

The plaintiffs were the NCAA plus the four US sports leagues:

- NBA

- NFL

- NHL

- MLB

The US Department of Justice was also a plaintiff. It was quite a case, and it was about more than just sports betting. The ruling touched on some of the nation’s core principles of states’ rights and anti-commandeering.

New Jersey was the rebellious child that turned against PASPA. Starting with voter approval in 2011, the state tried a couple times to establish a sports betting industry. The leagues brought suit against the state, though, which they had the standing to do under PASPA.

The mighty leagues won, initially and repeatedly. Through multiple stops in Circuit and District courts, the state was told it could not offer sports betting.

SCOTUS declined to hear the case at first, but it finally granted the state one final appeal in 2017. The parties argued their sides before the justices in December, and the ruling came down on May 14, 2018.

The court ruled for NJ — and for all states — overturning lower rulings and completely repealing PASPA. States can now do as they please when it comes to sports betting, without federal interference.

NY already has some preparations in place to take advantage, but as you can tell, there’s still some work left to do.

The post New York Now Has Legal Sports Betting! Well, Sorta… appeared first on Play NY.

NCAA Changes Its Tune On Sports Betting, Supports Federal Regulations

Long a fierce opponent of sports betting, and a plaintiff in the NJ sports betting case, the NCAA said Thursday that it would support “strong federal standards” and lifted the state ban on championships.

The post NCAA Changes Its Tune On Sports Betting, Supports Federal Regulations appeared first on Play NJ.

Churchill Downs Diving Headfirst Into PA And NJ Online Casino, Sports Betting

Churchill Downs is about to make a big splash in the legal and regulated online gambling and sports betting markets in both Pennsylvania and New Jersey.

The post Churchill Downs Diving Headfirst Into PA And NJ Online Casino, Sports Betting appeared first on PA Online Casino News.

Mikita Badziakouski Wins 2018 Triton Super High Roller Series Montenegro $1 Million HKD Buy-In

Mikita Badziakouski has won the 2018 Triton Super High Roller Series Montenegro $1,000,000 HKD ($127,396 USD) buy-in main event. The Belarusian poker pro outlasted a field of 63 total entries …

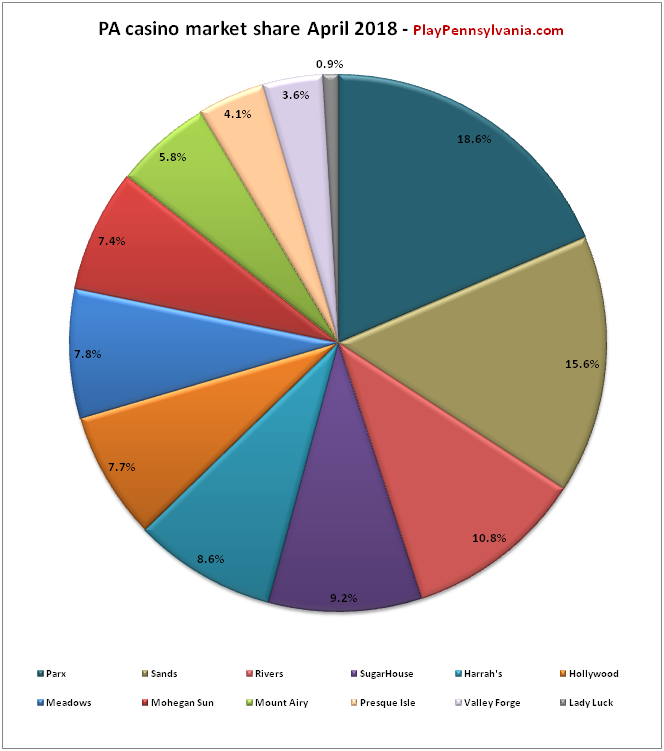

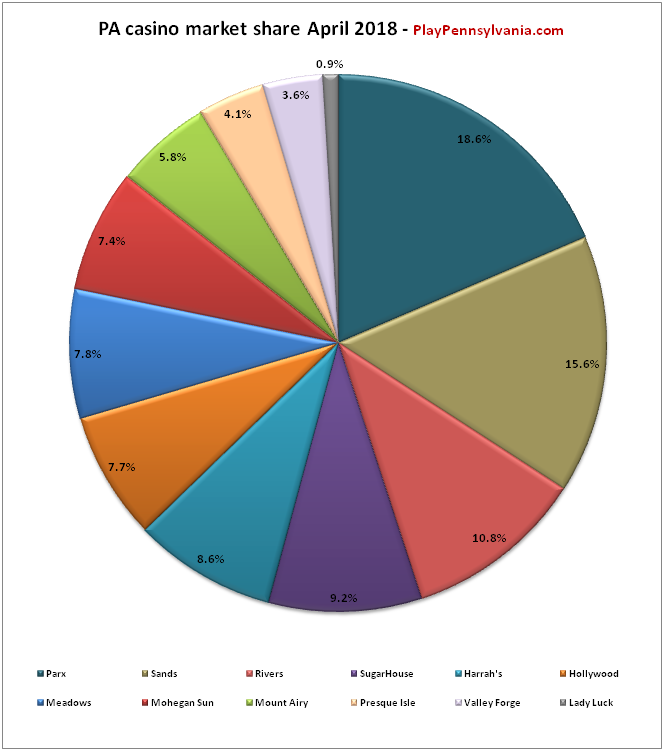

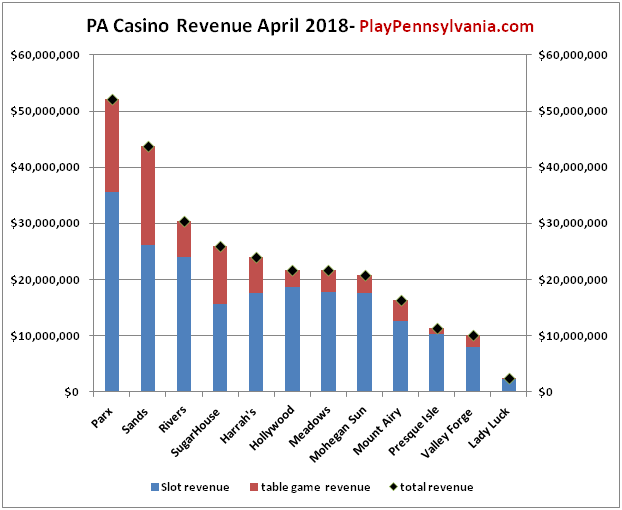

For Once It Is Table Games Bringing PA Casino Revenue Down

A slight uptick in slot revenue wasn’t enough to offset a brutal month on the table game side of the ledger for Pennsylvania’s casinos.

After posting the first $300 million month in its 14-year history last month, casino revenue came back down to Earth in April. Revenue fell nearly seven percent month-over-month and 1.5 percent year-over-year.

Top line numbers for April 2018

Here’s a look at the top line April numbers:

- Slot machine revenue: $206,178,527.52 (+.23 percent)

- Table game revenue: $74,667,615 (-6.19 percent)

- Total gaming revenue: $280,846,142 (-1.56 percent)

12-month slot revenue trend

After suffering through a yearlong slump, slot revenue has righted itself, with the industry posting Y/Y gains in five of the last eight months.

- May 2017 slot machine revenue: $203,248,175.70 (-2.68 percent)

- June 2017 slot machine revenue: $188,520,750 (-.77 percent)

- July 2017 slot machine revenue: $209,124,965.58 (-2.01 percent)

- August 2017 slot machine revenue: $193,190,477.69 (-.39 percent)

- September 2017 slot machine revenue: $195,396,966.03 (+1.69 percent)

- October 2017 slot machine revenue: $189,527,493.24 (-1.21 percent)

- November 2017 slot machine revenue: $181,329,655.27 (+1.08 percent)

- December 2017 slot machine revenue: $187,614,378.63 (+1.22 percent)

- January 2018 slot machine revenue: $177,795,127.32 (-1.39 percent)

- February 2018 slot machine revenue: $189,056,194.76 (-1.67 percent)

- March 2018 slot machine revenue: $221,350,220.10 (+5.41 percent)

- April 2018 slot machine revenue: $206,178,527.52 (+.23 percent)

Who was up and who was down in March

Just four of the state’s casinos beat last April’s numbers: Parx, Rivers, Harrah’s, and Presque Isle.

Half of the state’s casinos saw revenue decline by at least four percent: Mohegan Sun, Valley Forge, Meadows, Mount Airy, Sands, and Lady Luck.

- Parx Casino: +6.38%

- Rivers Casino: +5.53%

- Harrah’s Philadelphia: +3.66%

- Presque Isle Downs and Casino: 3.02%

- SugarHouse Casino: -1.28%

- Hollywood Casino at Penn National Race Course: -1.51%

- Mohegan Sun Pocono: -4.13%

- Valley Forge Casino Resort: -5.64%

- Mount Airy Casino Resort: -7.52%

- The Meadows Casino: -8.15%

- Sands Casino Resort Bethlehem: -9.52%

- Lady Luck Casino Nemacolin: -11.78%

Who won and who lost

Parx is leaving Sands in the rearview mirror

The gap between Pennsylvania’s top two casinos widened in April. Parx saw revenue rise 6.4 percent while Sands Bethlehem’s revenue dropped 9.5 percent.

Sands’ longstanding table-game dominance is also evaporating. Parx’s tally of $16.5 million is just over $1 million shy of Sands’ total, the closest the two have been since the state authorized table games.

Parx is fast-approaching a 20-percent market share in a 12-casino market.

Valley Forge growth streak comes to an end

Valley Forge’s hot streak came to an end in April, as the casino posted its first Y/Y revenue decline since October 2017.

April’s reversal is a bit of a head-scratcher considering Valley Forge’s revenue was up by double-digits in four of the previous five months, thanks in large part to the gaming reform package that removed the amenity fee (entry-fee) requirement passed last year.

- November 2017: +12.4 percent

- December 2017: +6.4 percent

- January 2018: +13.9 percent

- February 2018: +15 percent

- March 2018: +10.5 percent

When it came to slot revenue, Valley Forge had a strong month, posting nine percent Y/Y growth. But the strong slot performance couldn’t offset a nearly 40 percent Y/Y decline in table game revenue.

Looking ahead

Forecasting the coming months will be difficult. Gaming expansions the state okayed last year are expected to launch, not to mention the landmark decision by the Supreme Court on sports betting, which Pennsylvania preemptively authorized in the gaming reform package.

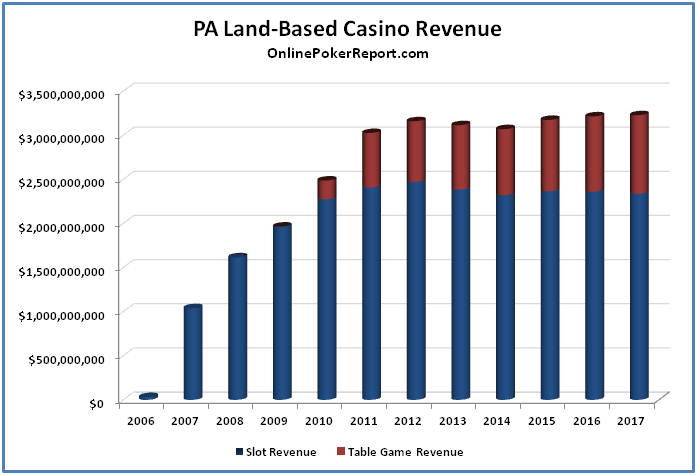

Historical look at casino revenue in Pennsylvania

The post For Once It Is Table Games Bringing PA Casino Revenue Down appeared first on Play Pennsylvania.